Navigating Tax Efficient Investments in Cross-Border Scenarios

Meta Description: Discover effective global investment tax strategies to maintain tax efficiency in cross-border investments. Our guide helps UK investors maximize returns while minimizing tax liabilities.

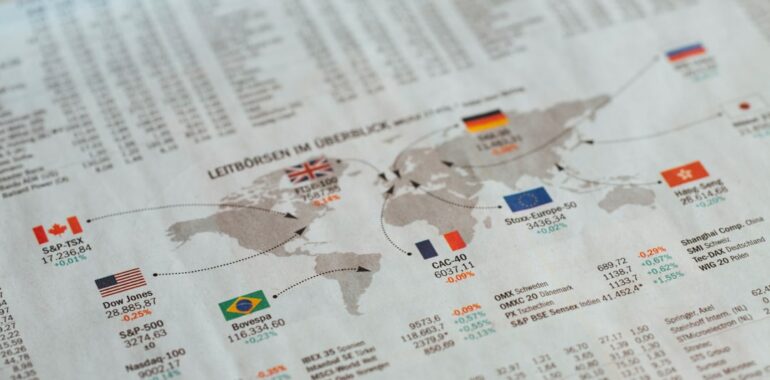

Investing across borders presents both opportunities and challenges, particularly when it comes to maintaining tax efficiency. For UK investors, understanding global investment tax strategies is crucial to maximizing returns and minimizing tax liabilities. This comprehensive guide delves into the complexities of cross-border investments and offers actionable strategies to navigate them effectively.

Understanding Tax-Efficient Investing

Tax-efficient investing involves employing strategies and practices designed to minimize tax liabilities while maximizing investment returns. By optimizing the tax impact, investors can retain more of their earnings and enhance overall portfolio performance. Key strategies include utilizing tax-advantaged accounts, selecting tax-efficient investment vehicles, and strategically timing income and capital gains.

Challenges in Cross-Border Investments

Investing internationally introduces additional layers of complexity to tax planning. When moving between countries, tax-efficient investments in your home country may become tax-inefficient abroad. For instance, the UK’s Individual Savings Account (ISA) offers attractive tax benefits domestically, but these advantages often diminish or disappear when an investor relocates internationally.

Example: The ISA Limitation

Consider an investor who has built a substantial ISA portfolio in the UK. If this individual moves to another country, the tax benefits associated with the ISA are typically not recognized by the host country. Consequently, income and gains generated within the ISA may become subject to local taxes, negating the original tax advantages.

Strategies for Maintaining Tax Efficiency

To preserve tax efficiency in cross-border scenarios, UK investors should consider the following global investment tax strategies:

1. Consult Tax Professionals

Engaging with tax professionals who specialize in international tax law is essential. These experts can provide tailored advice on how your investment portfolio will be taxed in your new country of residence and recommend necessary adjustments to maintain tax efficiency.

2. Realign Your Investment Portfolio

Based on the advice received, investors may need to realign their portfolios to better suit the tax environment of their new country. This could involve shifting investments to tax-advantaged vehicles available in the host country or diversifying into different asset classes that offer better tax treatment internationally.

3. Understand Host Country Tax Incentives

Researching and leveraging tax incentives in the host country can help mitigate the loss of benefits from home-based tax-efficient investments. Many countries offer their own versions of tax-advantaged accounts or investment incentives aimed at encouraging savings and investment.

Oriel IPO’s Role in Enhancing Tax-Efficient Global Investments

Oriel IPO is an innovative online investment hub that connects investors with entrepreneurs through SEIS (Seed Enterprise Investment Scheme) and EIS (Enterprise Investment Scheme) opportunities. Operating out of the UK, Oriel IPO focuses on democratizing investment, making it accessible to both experienced and new investors via a transparent, commission-free platform.

Benefits of Using Oriel IPO for Tax-Efficient Investing

- SEIS/EIS Opportunities: Access to tax-efficient investment schemes that provide significant tax reliefs, crucial for minimizing tax liabilities.

- Community Support: A robust membership structure fosters a strong community, offering educational resources and networking opportunities to enhance investment decisions.

- Secure Marketplace: Ensures safe and transparent investment transactions, crucial for maintaining trust and reliability in cross-border investments.

Case Studies: Applying Global Investment Tax Strategies

US to UK Scenario

An individual moving from the US to the UK, who holds US Municipal Bonds, will find that the interest income, previously exempt from US Federal Income Tax, becomes subject to UK taxation. By consulting a tax professional, the investor can assess whether to retain these bonds or realign their portfolio to UK-specific tax-efficient investments like ISAs, considering the new tax implications.

UK to US Scenario

A UK investor relocating to the US may face unfavorable tax treatments for existing UK Unit Trusts, classified as Passive Foreign Investment Companies (PFICs) by US tax law. This classification results in onerous tax reporting requirements and unattractive tax treatments. Through platforms like Oriel IPO, the investor can explore SEIS/EIS opportunities that align with US tax regulations, thereby maintaining tax efficiency.

Conclusion

Navigating tax-efficient investments in cross-border scenarios requires a thorough understanding of both home and host country tax laws. By leveraging global investment tax strategies, consulting with tax professionals, and utilizing platforms like Oriel IPO, UK investors can effectively manage their international investments to maximize returns and minimize tax liabilities.

Ready to optimize your cross-border investments? Join Oriel IPO today and take control of your tax-efficient investment journey.